The invention of financial cards, which are forms of plastic money that include credit, debit, and charge cards, is the result of a mature capital society and progress in economic development. Consumers require methods of payment that are both low-cost and convenient to use. Financial cards, now widely used around the world because of their portability and security, will help precipitate the realization of a less-cash society or even an entirely cashless society.

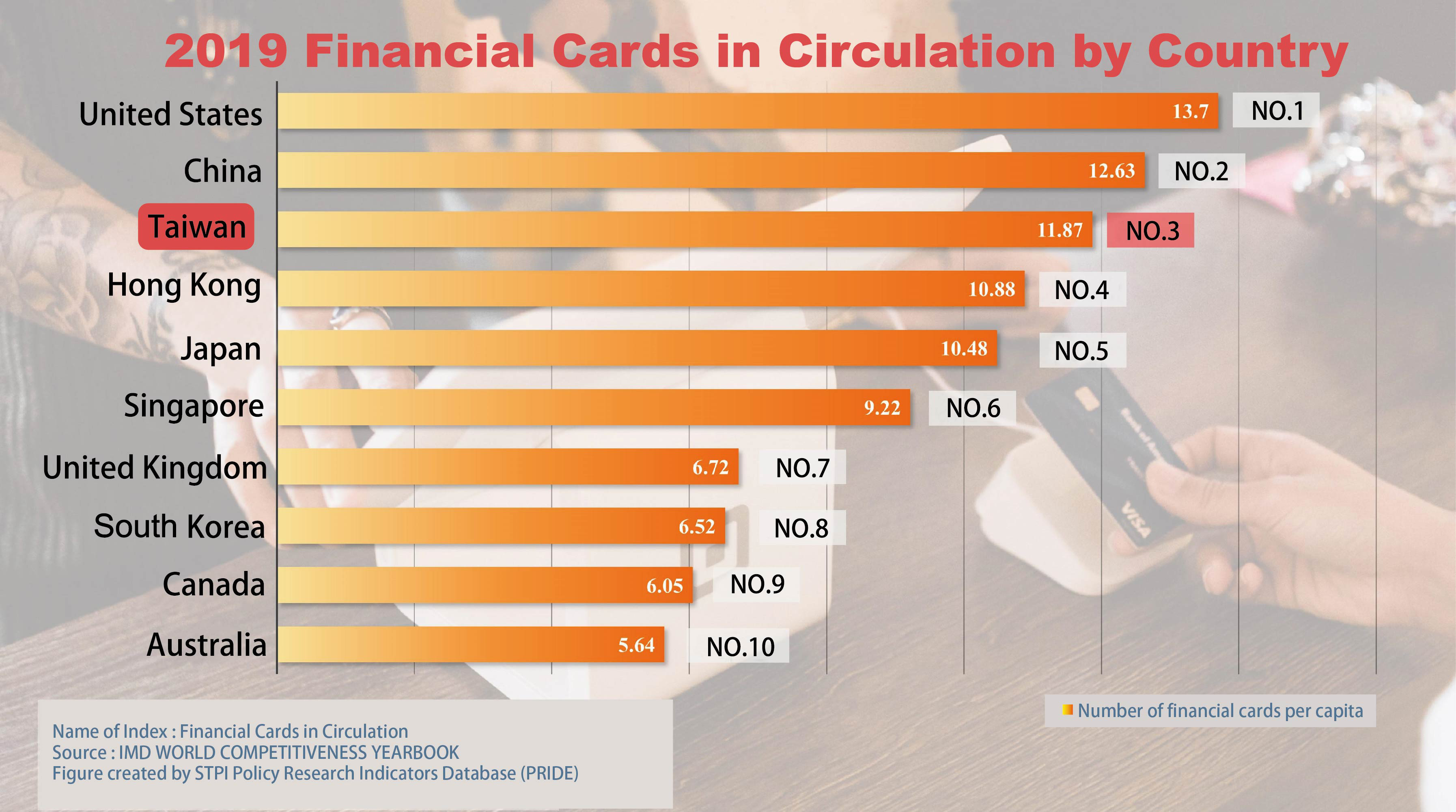

In the IMD World Competitiveness Yearbook 2020, 63 major economies worldwide were ranked in terms of “financial cards in circulation”. The U.S., birthplace of Visa and MasterCard, took the No. 1 spot, with 13.7 cards per capita, and China ranked second with 12.63 cards per capita. Taiwan ranked third, with 11.87 cards per capita, which attested to the popularity of plastic payment cards in the country. Other top Asia-Pacific economies on the list include Hong Kong (4th), Japan (5th), Singapore (6th), South Korea (8th), and Malaysia (24th). Countries also on the top ten list include UK (7th), Canada (9th), and Australia (10th).

Six of the top 10 countries were Asian and generally have well-developed financial infrastructures and software services industries. Taiwan was far ahead of the group in terms of the “financial cards in circulation” category principally because the country’s financial institutions have created a friendly card payment environment based on market considerations and consumers’ habits. Various types of financial cards can be linked with different payment platforms, and QR code payment at both brick-and-mortar outlets and online shopping websites is also supported, which satisfies consumers’ online and offline payment needs. In addition, convenience stores are generally equipped with ATMs. The extremely high density of these stores in Taiwan explains the widespread adoption of financial cards and consumers’ dependency on them.

The next step in the development of payment technology in Taiwan is the focus on mobile payment. By combining FinTech with the Internet of Things, artificial intelligence, and big data, and with the collaboration between the government and the financial services sector, Taiwan will be able to create a high-value and innovative financial environment that will help propel the nation into an affluent digital economy and meet the citizens’ demand for smart payments.

Related

- News 2019 Win the PRIDE: High School Students Won Award by Analyzing Offshore Wind Potential in Taiwan

- News Global AI Index 2020

- News Life Made Different with MRT

- News Heavy Metal Lead – A Cause of Serious Health Problems

- News How “Free” is Taiwan’s Economy?

- News Pork and Beef Production in Perspective

- News I Need A Job

- News Sustainable Development Goals

- News Venture Capital Supports Startups

- News Who is the King of Voyage?

- News Migrating Across Thousands of Miles

- News Investment Incentive Policies

- News The Competitiveness of Taiwan

- News Paradise for Immigrants

- News Smart City

- News Sunrise vs Sunset

- News The Battle between the Railway Duo

- News Hunger Knows No Boundaries

- News Clean Cooking

- News How are Science Parks Faring in This Economy?

- News Booming Auto Sales

- News Airports Under the Tyranny of COVID-19

- News Gaining the Upper Hand Over the Pandemic

- News Making Ends Meet Isn't Enough Anymore

- News Democracy

- News Save Our Planet

- News Women's Disposable Income Worldwide

- News Connecting Everyone on the Internet

- News The Inheritance of Men and Women: A Wealth of Difference

- News From Small Steps to Great Wealth

- News Family Life During the Pandemic

- News Exploring the Journey of Trade