Earlier families and societies used to cherish ideas like "prizing boys over girls" or "passing on sons over daughters"; hence men were almost always the ones inheriting a family business or fortune. However, in recent years, growing female consciousness and equal rights protection under the rule of law have led to greater respect for women's rights. This article examines relevant social trends from a taxation perspective by analyzing the changes in men's and women's inheritance over a 14-year period.

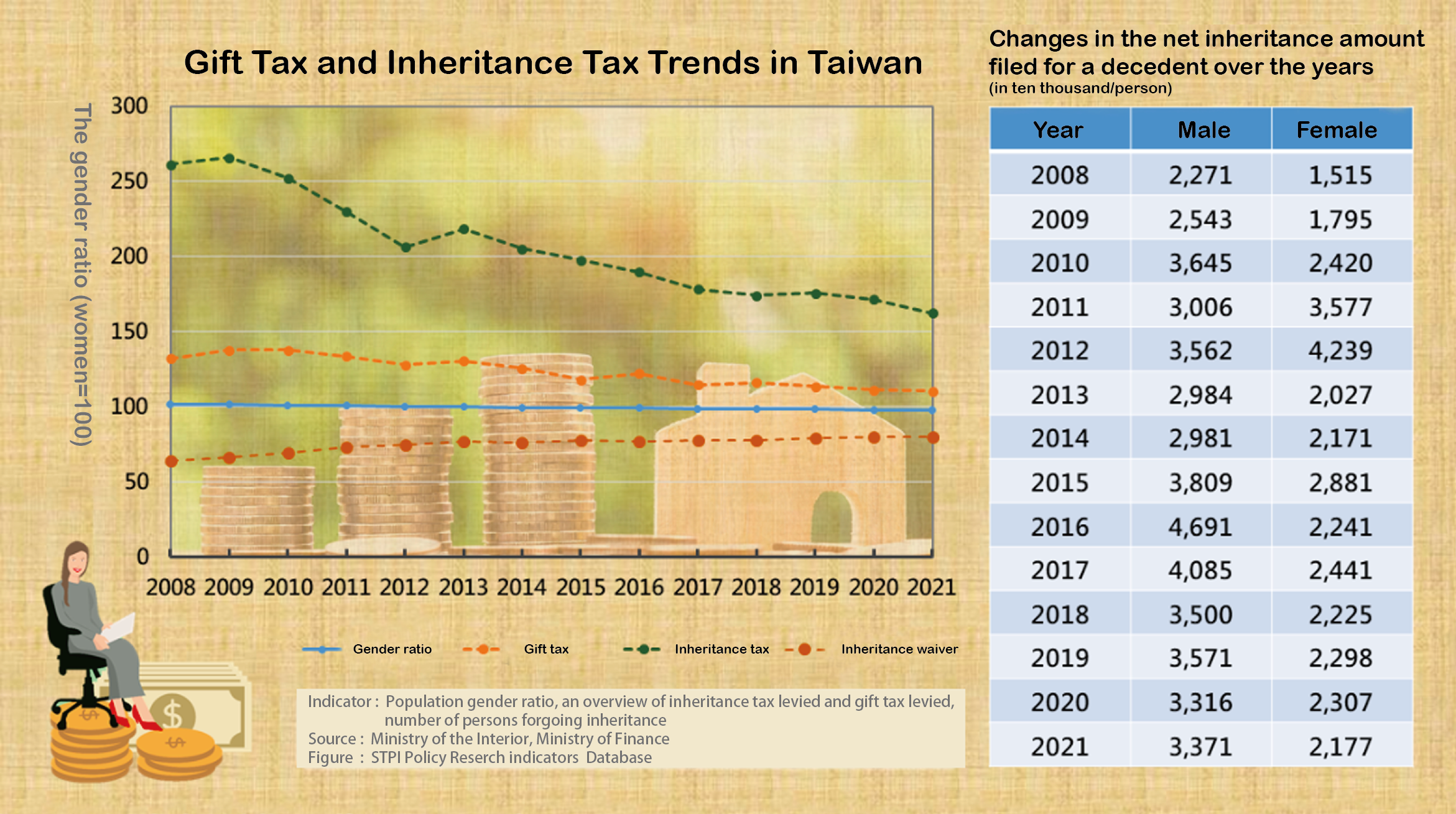

The gender ratio in Taiwan is close to 1:1. In 2008, the ratio of women to men was 100:101.9; in 2021, it was 100:98.1, indicating a slight decline in the male ratio. When looking into property gifting, a common financial planning strategy, it can be seen that the women-to-men ratio of gift tax filings was 100:132.1 in 2008 and 100:137.7 in 2010. Since then, gift tax filings by women have been increasing year after year, reaching a women-to-men ratio of 100:110.4 in 2021. Meanwhile, for inheritance tax filings, the gender ratio difference reached its highest at 100:266.1 in 2009, then dropped significantly by 38.8% to 100:162.6 in 2021. In addition, the gap between women and men in forgoing their inheritance has also been seen closing. For instance, the ratio of women to men forging their inheritance was 100:64.5 in 2008 and 100:80.4 in 2021.

Regarding the net inheritance amount of levied cases, the net inheritance amount filed for a male decedent was NT$ 22.71 million in 2008. The number reached a record high of NT$ 46.91 million in 2016, then continued to decline yearly to NT$ 33.71 million in 2021. Meanwhile, the net inheritance amount filed for a female decedent was NT$ 15.15 million in 2008, which surpassed that of a male decedent for the first time in 2011 and peaked at NT$ 42.39 million in 2012. The amount fell to NT$ 20.27 million in 2013 and maintained an average of NT$ 23 million between 2014 to 2021.

With a gender ratio of nearly 1:1, the number of gift tax filings by men as well as the number of inheritance tax filings for male decedents and their net inheritance amount (except for 2011 and 2012), is still greater than those of women. Nevertheless, the number of gift tax filings by women and the number of inheritance tax filings for female decedents and their net inheritance amount is increasing year by year, reflecting women's growing economic power and possibly the subsiding of old values that attribute women to inferiority.

Related

- News 2019 Win the PRIDE: High School Students Won Award by Analyzing Offshore Wind Potential in Taiwan

- News Global AI Index 2020

- News Life Made Different with MRT

- News Heavy Metal Lead – A Cause of Serious Health Problems

- News How “Free” is Taiwan’s Economy?

- News Pork and Beef Production in Perspective

- News Our Relationship with Financial Cards

- News I Need A Job

- News Sustainable Development Goals

- News Venture Capital Supports Startups

- News Who is the King of Voyage?

- News Migrating Across Thousands of Miles

- News Investment Incentive Policies

- News The Competitiveness of Taiwan

- News Paradise for Immigrants

- News Smart City

- News Sunrise vs Sunset

- News The Battle between the Railway Duo

- News Hunger Knows No Boundaries

- News Clean Cooking

- News How are Science Parks Faring in This Economy?

- News Booming Auto Sales

- News Airports Under the Tyranny of COVID-19

- News Gaining the Upper Hand Over the Pandemic

- News Making Ends Meet Isn't Enough Anymore

- News Democracy

- News Save Our Planet

- News Women's Disposable Income Worldwide

- News Connecting Everyone on the Internet

- News From Small Steps to Great Wealth

- News Family Life During the Pandemic

- News Exploring the Journey of Trade